tl/dr

OpenAI introduced Apps in ChatGPT at their 2025 DevDay, after posting about ChatGPT Instant Checkout and the Agentic Commerce Protocol a week earlier.

E-commerce is entering a new phase as agentic commerce—where AI agents shop, compare, and transact autonomously—becomes operational. Mastercard, Visa, and Stripe are leading this change with distinct initiatives: Mastercard’s Agent Pay, Visa’s Intelligent Commerce, and Stripe’s Agentic Commerce Protocol (ACP). These systems are redefining digital transactions by embedding AI-driven trust, security, and interoperability into global payment infrastructure.

What Is Agentic Commerce?

Agentic commerce is a system in which autonomous AI agents act for consumers or businesses to find, evaluate, and complete purchases. Instead of manually browsing and paying, users delegate this to agents such as chatbots, voice assistants, or enterprise procurement bots configured with preferences and spending limits.

The model builds on advances in generative AI and large language models that allow users to offload transactional tasks to intelligent software. This creates faster, more personalized shopping experiences and helps reduce abandoned carts and decision fatigue [Omakase].

Mastercard Agent Pay: Secure, Tokenized AI Payments

Mastercard’s Agent Pay enables AI agents to make secure payments on behalf of users, using Mastercard’s global payment network and tokenization system. Key features include:

- Agentic Tokens: Each payment uses a temporary, agent-specific token tied to the user’s account. Real card data never leaves Mastercard’s environment [Agentic Commerce Agency].

- Agent Registration: Only verified and approved AI agents can obtain and use tokens.

- User Controls: Users can define transaction rules such as limits, allowed merchants, and approval requirements.

- Seamless Integration: Works with conversational AI systems to complete payments directly in chat or voice interfaces.

- Security: Incorporates biometric passkeys and real-time fraud detection to authenticate every transaction.

Use Cases:

- A personal assistant that compares product prices and buys within spending caps.

- Automated business purchases where a corporate agent sources office supplies and pays according to internal policies.

- Enterprise integrations with Microsoft Copilot and IBM watsonx Orchestrate [Mastercard Press Release].

Visa Intelligent Commerce: AI-Ready Cards and Trusted Transactions

Visa Intelligent Commerce and Agent API offer a set of APIs and developer tools that allow AI agents to transact securely within Visa’s network and transact on behalf of users.

- AI-Ready Cards: Traditional numbers are replaced by tokenized digital credentials linked to individual agents and activated only with user consent [Visa Press Release].

- Personalization: With explicit permission, Visa shares transaction insights to improve agent recommendations.

- Spending Controls: Users can set limits, define merchant categories, and enable real-time approvals.

- Authentication: Payment passkeys verify both the user and the AI agent before authorization.

- Monitoring: Visa analyzes live transaction data for risk assessment and dispute support.

- Agent API: A dedicated API suite allows developers to integrate AI agents with Visa’s tokenization, authentication, and personalization and commerce signals [Visa Developer].

Ecosystem Partnerships: Collaborations with OpenAI, Microsoft, Anthropic, and Stripe enable integration into existing and emerging AI systems rather than creating a standalone Visa agent [Retail TouchPoints].

Stripe Agentic Commerce Protocol: Open Standards for AI-Driven Transactions

Stripe’s Agentic Commerce Protocol (ACP) is an open-source framework developed with OpenAI to define how agents, merchants, and payment processors interact in agentic commerce scenarios [Stripe Blog].

- Shared Payment Tokens (SPT): Agents receive programmable tokens that authorize payments under specified limits, such as merchant, amount, and time. These can be revoked instantly.

- Open Standard: ACP allows one integration to serve any compatible AI agent across platforms [Agentic Commerce Protocol].

- Merchant Control: Businesses remain merchants of record, maintaining customer relationships and fulfillment.

- Security: Stripe’s fraud detection tools (Radar) are built into ACP to identify suspicious agents.

- Active Deployment: Instant Checkout in ChatGPT lets users purchase from Etsy and Shopify directly within a chat [OpenAI Announcement].

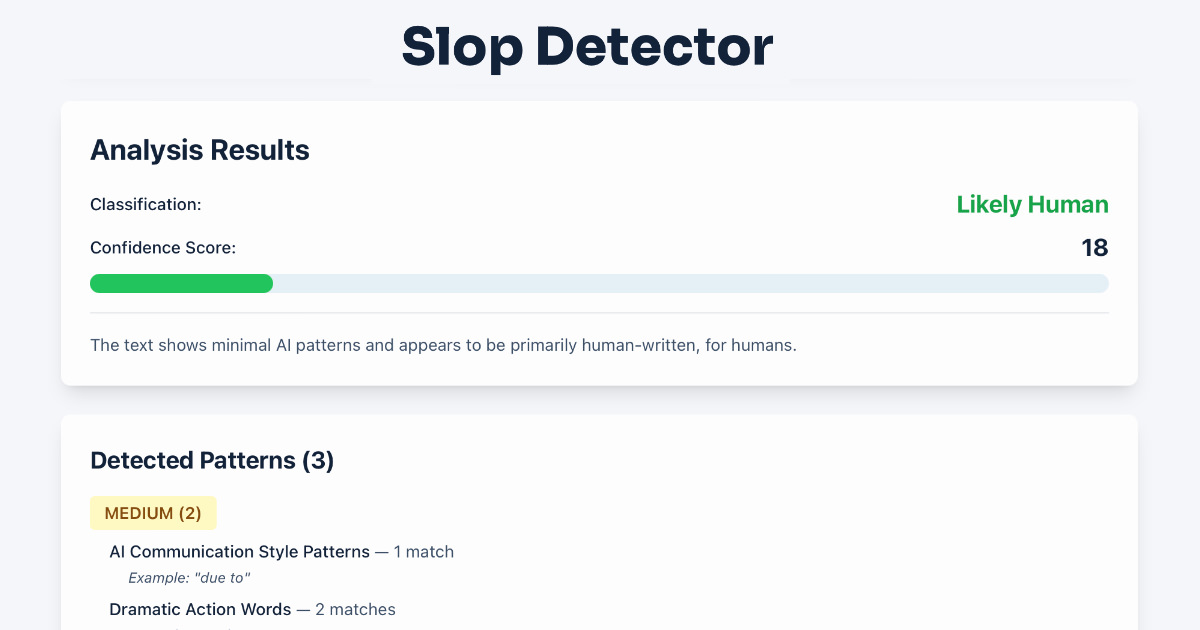

Comparative Overview

| Feature / Provider | Mastercard Agent Pay | Visa Intelligent Commerce | Stripe Agentic Commerce Protocol (ACP) |

|---|---|---|---|

| Tokenization | Agent-specific tokens | AI-ready digital cards | Shared Payment Tokens (SPT) |

| User Controls | Spending rules and limits | Real-time approvals and limits | Programmable token permissions |

| Agent Registration | Verified agents required | Agent onboarding required | Any agent supporting ACP |

| Integration | Conversational and enterprise AI | APIs for AI ecosystems | Open, cross-platform standard |

| Security | Passkeys and fraud screening | Passkeys with live monitoring | Token scoping with fraud detection |

| Merchant Experience | No change for tokenized merchants | Works with existing partners | Merchant retains full control |

| Key Partners | Microsoft, IBM, Braintree | OpenAI, Microsoft, Stripe, Anthropic | OpenAI, Shopify, Etsy, others |

The Future of Agentic E-Commerce

Emerging Patterns:

- Frictionless Shopping: AI agents streamline discovery and checkout, minimizing manual effort.

- Personalization: Agents use user-approved data to refine suggestions and automate repeat purchases.

- Security Foundations: Tokenization and continuous monitoring are central to user confidence.

- Merchant Readiness: Businesses must provide structured, machine-readable product data to stay accessible to agents [Stripe Guide].

- Shared Standards: Interoperability between systems is shaping through collaborations among Mastercard, Visa, and Stripe.

Persistent Issues:

- Fraud Risk: Detecting rogue bots requires stronger authentication and behavioral analysis.

- User Control: Transparent data and spending governance remain essential.

- Retailer Skepticism: Some merchants resist intermediated transactions that weaken direct customer contact [StarpointLLP].

Final Thoughts

Mastercard, Visa, and Stripe are introducing frameworks that make AI commerce secure and scalable. Their combined efforts are defining how digital agents will transact in coming years, influencing both consumer behavior and merchant strategy.

More at Mastercard’s Agent Pay, Visa Intelligent Commerce and Agent API, and Stripe’s Agentic Commerce Protocol.

Of note, PayPal also announced agentic commerce tools, including an MCP server.